tax loss harvesting rules

2022 has been a volatile year in the stock market. The 3000 deduction uses up your net short-term capital loss of 250 850 - 600 and 2750 of your net long-term capital loss resulting in a balance of 3725 7500 -.

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

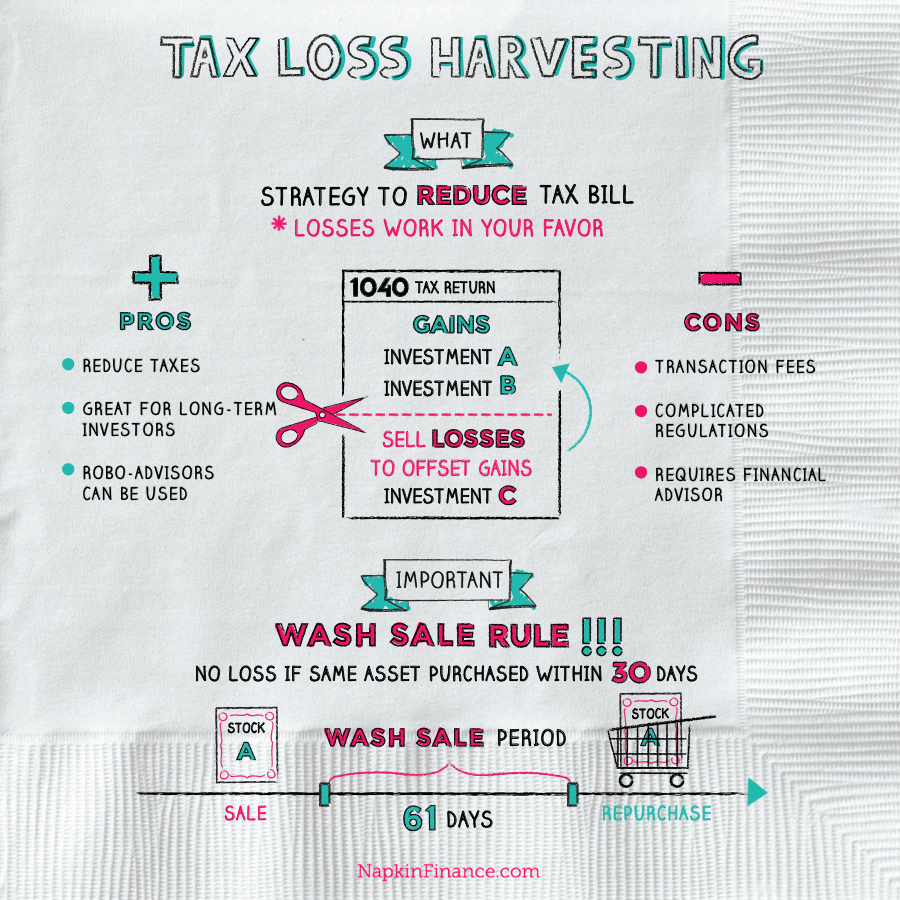

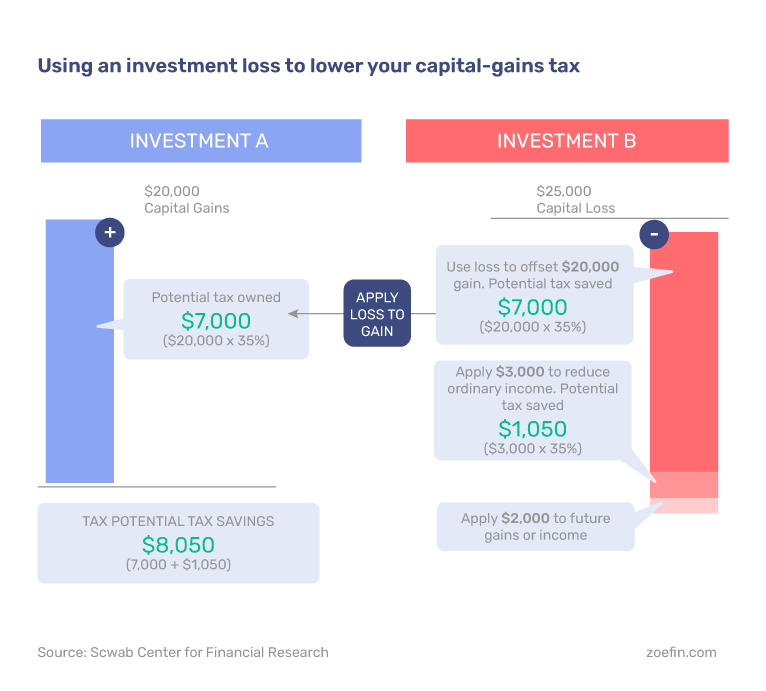

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end.

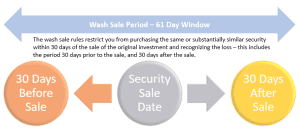

. Tax-loss harvesting cant be used on retirement plans such as 401 k IRAs or other accounts where taxes are deferred. But theres a silver lining. Be Aware of Wash-Sale Rules.

Tax-loss harvesting is an excellent method for reducing tax obligations but this lesson explains how investors must also be aware of IRS rules and limits when considering this strategy. Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the. Your investments need to be in a taxable investment account.

To do it you simply need to lock in a loss by selling the. Of course the IRS has some. You have to use short-term losses to.

Some investment accounts like your 401k 403b or IRA are tax-advantaged. Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital. There are some rules to keep in mind.

This has been a tough year for many investors but investments in negative territory may still do some good. Lets discuss the rules and basics of tax-loss harvesting. Tax loss harvesting rules are necessary to be aware of as it does not allow investors the liberty to buy or sell stocks anytime based on the realized losses and profits.

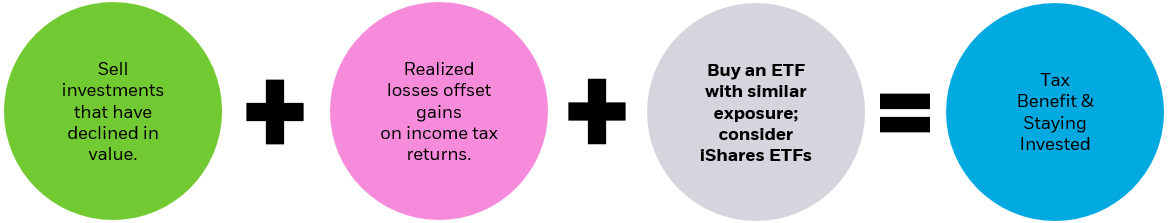

The strategy known as tax-loss harvesting allows you to sell declining assets. As you approach this with your clients. Every tax jurisdiction will have its own rules applicable to tax loss harvesting.

As with any tax-related topic there are rules and limitations. Year-end planning will undoubtedly include tax-loss harvesting to offset capital gains for many clients. Here are three things youll want to watch out for as you use this tax break.

You can only do tax-loss harvesting in your taxable brokerage accountsnot in 401ks or IRAs. Tax-Loss Harvesting Rules 1. Tax-loss harvesting is a strategy used to reduce your taxes.

In the United States the IRS has adopted a rule where a taxpayer cannot offset more than 3000. The chance to turn losses into tax breaks as long as you follow the rules. You may be able to lower your tax bill by harvesting losses.

These rules prohibit selling an asset to capture a deductible tax loss and then. To prevent tax-loss harvesting abuses Congress created the wash-sale rules. This article explores tax-loss harvesting and also covers capital gains and capital loss.

Three things to watch out for when harvesting a loss. Last Updated July 20 2022 544 pm EDT. Tax loss harvesting is a method in which an investor realizes losses by selling securities that currently have a fair market value that is lower than its cost base.

Turning Losses Into Tax Advantages

Tax Loss Harvesting How To Reap The Most Rewards Diligent Dollar

Quiz Worksheet Tax Loss Harvesting Study Com

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

Watch Out For Wash Sales Charles Schwab

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Top 5 Tax Loss Harvesting Tips Physician On Fire

Finding Silver Linings With Tax Loss Harvesting Ishares Blackrock

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

What Advisors Need To Know About Tax Loss Harvesting

Year End Financial To Do Considering The Tax Loss Harvesting Strategy Benjamin F Edwards Financial Advisors November 26 2019

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

Tax Loss Harvesting What Does It Mean To Be Substantially Identical Biglaw Investor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker